The following is from an answer I wrote to a similar question posted on Quora. Original question:

I read this onlinel “US digital marketers or web developers (service providers) don’t need to levy taxes on services because there is no sales tax on “intangible goods” in the US, which includes services such as online tutoring, digital marketing, social media, online marketing, etc.” Is it correct?

First of all, the very fact that you are asking this question makes me think that you need to meet with an accountant in your state, if even just to discuss your business needs in an introductory visit. That being said, this is Quora after all, so while you contemplate actually paying an accountant, here’s the free version:

Income Tax

Yes, you need to pay this. You will pay this at least on a federal level, and possibly on a state and local level as well. When you are employed by someone, they take taxes out for you with each paycheck, and pay half of your responsibility for Social Security and Medicare (7.65% of your income, this is called your FICA payment).

When you work for yourself, you are both the boss and the employee, so you will pay an income tax percentage based off of your income bracket, and 15.3% for the first $118,500 in earned income for FICA (7.65% as the employer, and 7.65% as the employee). After $118,500 you only need to pay 2.9%.

To make matters more confusing, you will need to pay this income tax on a quarterly basis (much like your employer pays it whenever you get a paycheck). Fortunately, there is a “safe harbor” provision, in that you won’t be penalized if this is your first year of business ( there are a couple more requirements for safe harbor).

If you use a tool like TurboTax to file your taxes, they’ll print out your estimated payments for the next year along with vouchers to mail in to the IRS on certain dates. It’s pretty straight-forward to comply during your second year of business.

Unless you live in one of these states without income tax, you’ll have to calculate that as well:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

Your local income tax will depend on your individual municipality, but do not apply to townships.

tl;dr: Move to a township in Florida and you’ll stay warm and keep more of your income.

For more information, read Tax Organization Tips for Freelancers.

Sales Taxes

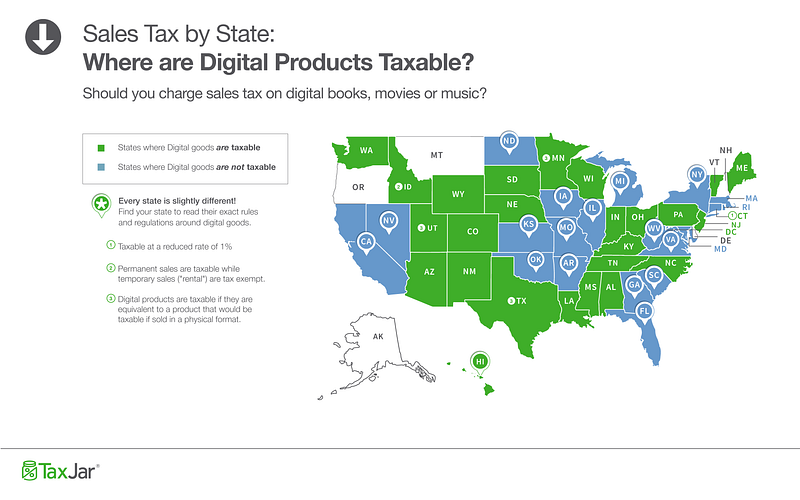

What you read online is incorrect. You can stop right after reading that they are providing sales tax advice across the entire United States. Sales tax is a state issue, and each on of them is slightly different. Some states tax digital products, some don’t, and some differ in their definition of a taxable digital good (based off of whether or not it could come in a physical format that would be taxable, like a book).

Photo credit: TaxJar

Adding to the complication, you are only responsible for charging and submitting sales tax for clients within your own state. Well, officially any state that you have a nexus (physical location, employee, property). For example, I live in Ohio. Anything I purchased on Amazon did not require sales tax to be collected until Amazon opened a distribution center in Ohio, then it was all taxed.

Clients outside of your state are supposed to declare their own purchase and pay state taxes on that (but in practice, I’m guessing this doesn’t happen much).

So, my word of advice here? Find your state in this list for more information about your particular state’s income tax and your responsibility for collecting and submitting it.

Video Bonus if you’re Canadian: Check out this video where I sit down with a real live Canadian and talk Taxes for Freelancers in Canada.

However, my actual final word of advice is to see an accountant. The initial consultation will likely be free, and they will help you with next steps.

Disclaimer: Neither Ryan Battles nor Harpoon provides tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.