Whenever you use your car to run your business, outside of an ordinary use, you can count that as an expense against your income to reduce your overall taxable income. There are two methods that can be used to track this information: actual expense method and standard mileage rates.

Few business owners opt for the actual expense method, as it requires detailed tracking of the actual costs involved in operating a car for the portion of the overall use of the car that is related to business use. This includes tallying, then declaring a relative portion of:

- Gasoline

- Oil & Oil Changes

- Repairs

- Tires

- Insurance

- Registration Fees

- Licenses

- Depreciation

These expenses can add up, so it is definitely worth your time to count them against your taxable income. However, the method of actual expense tracking can be very intensive, so fortunately there is another method which involves simply counting up your miles driven for business use, then multiplying those by a standard deduction amount.

In 2021, the IRS allows for 56 cents per mile driven for business use. In 2020, this rate was 57.5. Every year a new rate is set by the government, so it is important to double-check come tax time which rate is to be used for that tax year.

Qualifying Mileage for Business Use

According to the IRS, business travel expenses are "the ordinary and necessary expenses of traveling away from home for your business, profession, or job." This includes such travel as:

- Meeting with a client

- Traveling to the post office for business mailing

- Traveling to the store to purchase business items

- Traveling to conferences or events

Unfortunately you cannot deduct the miles needed to drive to your ordinary place of business. The exception to this is if for some reason your ordinary place of business becomes temporarily unavailable, and instead you have to travel to a temporary work location, you can deduct the difference needed to get you to this temporary work location. However, this is likely a rare occasion and should be used carefully.

What You Should Be Tracking

A basic ledger of your business mileage will include the following:

- Dates of your trips

- Mileage for each trip (note: you don’t need odometer readings for each trip)

- Business purpose of the drive

- Locations of the places you drive

These should be enough information to explain your business travel in the case of an audit.

Avoiding Red Flags that Trigger Audits

Audits are never fun. At best you have to work to prove that you are telling the truth in your tax reports, at worst an error is discovered in your reporting and you have to pay a fine or face jail time for larger cases. It is generally within your best interest to avoid these red flags that may trigger an audit:

- Declaring a round number. Declaring that you've driven 20,000 miles exactly for business is likely to be seen as an estimation, and may trigger an audit to see details of these trips.

- Claiming all of your miles for business use. If 100% of your miles driven by a car are for business use, this may be seen as a generous definition of what you mean by "business use", and an audit might be triggered to clarify all of your use cases.

- Claiming a particularly high number of miles. If your miles claimed take you far outside of what someone else in your industry typically claims for mileage, this is a pretty clear indicator of an audit coming your way to show the agent why your miles are so abnormally high.

Of course, with clear records and detailed tracking, an audit doesn't have to be a scary thing. Fortunately there are tools like Harpoon that allow for mileage tracking as it happens, so your reports at the end of tax time will be backed up with a detailed account of where those miles have been driven, for what purpose, and when.

Using Harpoon for Mileage Tracking

With Harpoon, we not only help you to track general business expenses, but we have a dedicated mileage tracker as well. This includes custom settings for:

- Units: Pick between Miles or Kilometers.

- Rate: Set the appropriate mileage rate for your country.

- Vehicles: List the different vehicles you use for business trips.

- Business Purposes: Customize the list of business purposes to attach to each recorded trip. (A default list from the IRS is supplied for you.)

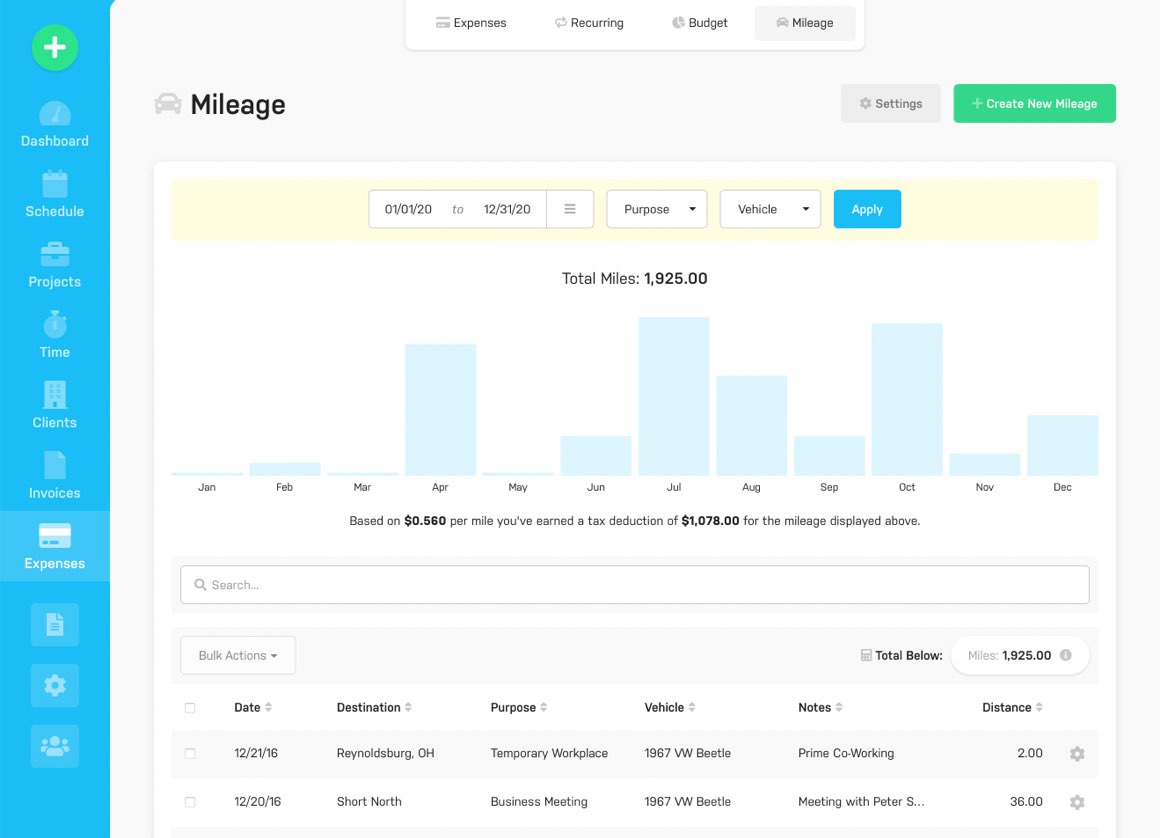

You can then record and manage your mileage via Harpoon's dedicated Mileage screen:

This provides a visualization of your trips over time, including an estimate of your earned tax deduction.

Harpoon also provides a detailed Mileage Report with PDF & CSV exports to send to your accountant or other stakeholders.

No matter which method you choose to track your business travel mileage, it's important to keep accurate records and adopt a habit of recording miles driven for business expenses. The deductions do add up quickly, and can be the difference that makes your freelancing business a profitable one.