How do I track taxes on my expenses?

In your country you might be required to track the amount of taxes you pay on the expenses your business incurs. In your Harpoon account you'll find a dedicated Taxes screen in your Settings that allows you to create and manage all the different kinds of taxes you’re responsible to track on your expenses.

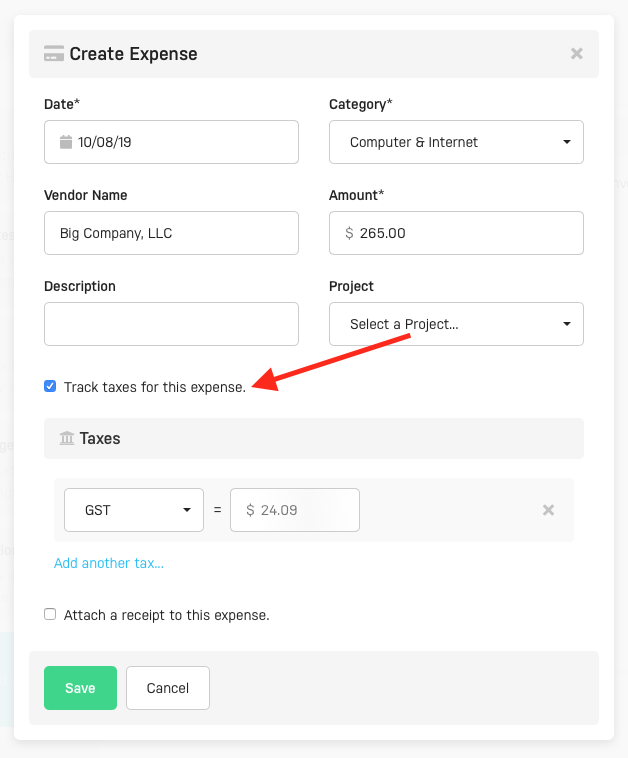

On this Taxes screen you have the freedom to create as many tax types as you need (e.g. VAT, GST, PST, HST, etc.), including the name, rate, and optional ID for each tax. The global taxes you create in your Settings will now show up as available options for your expenses. When creating or editing an expense you’ll see a tax tracking checkbox available.

Selecting this option will reveal a tax interface for your expense:

Here you can select from any of the global taxes you created in your Taxes settings. When a tax is selected Harpoon will automatically calculate how much of the expense’s total amount was a tax based on the rate of the selected tax. If you need to track more than one tax on the expense keep adding as many taxes as you need and Harpoon will automatically recalculate the tax amounts for you.

Tax Summary Report

With all of these taxes being tracked with your expenses you’re going to need a simple way to summarize and share this tax data with your accountant. For that we’ve provided a Tax Summary Report.

The Tax Summary report will list every tax applied in your Harpoon account (for both invoices and expenses) within a selected date range.

For each tax applied the report will provide the total Taxable Amount of both the invoice payments you’ve collected and the expenses you’ve recorded, and the Net difference between the two. The report will also provide the total amount of Taxes for those same invoices and expenses on a per tax basis, and the Net difference between the two.