One of the best parts of running your own business is the ability to deduct items as a cost of doing business. Before running my own business, I’d often hear people say:

“It’s expensive, but that’s okay, it’s deductible.”

What exactly do they mean by this? Well, a deductible expense is something that you purchase in order to run your business, and you don’t have to pay taxes on the money that you spent on this item. This is vastly different from a tax credit, which is a 100% subtraction from the amount of taxes you owe. Generally, depending upon your tax bracket, this equates to about 21% of what you pay for a cost or service is subtracted from your total tax bill.

For example, let’s say you make $200, but $100 of that is deductible. If your tax rate is 20%, you will pay only $20 in taxes instead of the $40, because only half of that income is taxable (taxable income is the remainder of whatever is not deductible).

One of the keys to making the most money in your business is claiming the most deductions that you are legally able to, so your tax bills are lower, leaving more money in your pocket.

What Expenses are Deductible?

A general rule of thumb is that any expense that has to do with running your business can be a deducted from your taxable income. It’s not all that simple though, because many people think some expenses are deductible, when in fact they are not:

- Gas to and from the office

- Coffee while you work at Starbucks

- Paying for your own lunch at a meeting

Why aren’t these deductible? It seems like they should be, since they are expenses incurred while running your business.

For the first one, normal commuting is simply not a deductible expense. If you are traveling to meet with a client, or to a conference, that is deductible, but not your everyday commute.

The other two fall under expenses that you would normally pay anyway. There’s an old 1953 court case (Sutter v. Commissioner of Internal Revenue) that states that you can’t deduct entertainment expenses just for yourself if you’re paying what you normally pay for something. Now, if you pick up the tab for someone else, that changes things, but you can only deduct 50% of the total bill anyway, so you’re still paying for your own without a deduction.

Now that was the bad news, here’s the good news, there’s still so much to deduct! As a freelancer, you should be aware of each and every deduction that you can take in order to maximize your business health.

Travel and Mileage

Going to a conference? Meeting with a client? Picking up supplies from Office Max? Traveling to Ikea to furnish the office? All of these are travel related expenses and can be deducted. The miles you drive in your car, the cost of your flight, the fees for parking (but not your tickets for illegal parking), car rental, etc. All of this falls under travel expenses as long as the trip is for business purposes.

Harpoon makes it easy to track your mileage and print out a report come tax time. Even small trips add up, so record even small runs around town.

In 2021, the IRS allows for 56 cents per mile driven for business purposes to be deducted. Think of it this way, for every two miles you drive you deduct another dollar from your taxable income. This can surely add up fast!

What about mixed travel? Say you are traveling to meet with a client in Orlando, but you also spend a little time riding Space Mountain with the family. Obviously you can’t deduct the $100 tickets to the Magic Kingdom, but what about the flight and hotel?

Unless the primary reason for your trip is for business, you can’t deduct your travel expenses save for the trip from your hotel to the meeting place. The only exception to this is if you are required to be in that location on two dates on either side of a weekend, then the weekend becomes allowable as a business day, and you can deduct the cost of travel to and from that location (think: you were going to have a weekend off anyway, so the IRS won’t punish you for leisure activities during that time).

Example:

You have to meet with a client on Friday and the next Monday. You fly in on Thursday, which counts as a travel day and is therefore deductible, the Friday of the meeting is deductible, the weekend is deductible as long as you need to be there after the weekend, and Monday is deductible for business. If you fly home on Tuesday, that’s deductible too because it is a travel day. This trip’s flight and hotel would be 100% deductible.

Let’s say you fly home on Wednesday, and take Tuesday to golf. Your trip is still primarily for business, but one of those was a personal day, so out of the 7 days (Thurs-Wed) that the trip consists of, one of those was personal, so you will only be able to deduct 6/7ths, or about 86% of your travel expenses.

If your personal days are greater than 25% of the trip, chances are you won’t be able to deduct your travel expenses to the destination.

Home Office

Do you have a home office? Great, you can deduct a portion of your rent or mortgage now to pay for it! Do you have a spare bed in that office for guests? Hmmm, now it is a mixed use space, and technically not 100% deductible.

In order to deduct your home office, your must meet the following criteria:

- Exclusive use: the space is not used for personal reasons outside of what might be allowed at a normal workplace. If there is mixed use, then a clear partition must exist between the business and personal spaces (room divider, etc.)

- Regular use: interpretation of regular use will vary depending upon your need of that space, just be aware that “regular use” is a criteria that an auditor will want to see evidence of.

- Principal use: this must be the primary place for your business to take place. For example, if you pay for an office and spend most of your time there, a home office deduction is not allowed since it is a secondary place of business. Now, if you spend most of your time at a dayjob, and then use your home office for freelancing on the side, then you still use the space as a primary location for the freelancing business, and can deduct it from your freelancing income.

Unpaid Invoices

What happens when a client doesn’t pay an invoice? Can you deduct that expense? Well, that depends. You can only deduct the portion of an invoice that is for a tangible good or expense, and your time is not eligible for deduction. This can be a real bummer, because if you charge $100/hr and work on a project for 40 hours and the client doesn’t pay, then you aren’t able to claim that $4,000 as a deduction.

While this is frustrating for those of us who bill for the time we spend on a project, I can see where the IRS is coming from, because what is to stop me from saying I really spent twice the amount of time on it and was going to charge twice the hourly rate?

That being said, if you pay a contractor $200 and spend $50 on a website template, in addition to your time, then you can at least deduct these tangible expenses.

The Easy Ones

The previous deductible categories are some of the more commonly misunderstood expense categories. For many other categories, the deductions are pretty straight forward:

- Professional Development - Magazines, books, conferences, courses, etc. If it helps you become better at running your business, you can deduct the cost.

- Advertising and Marketing - Costs associated with your website, hosting, business cards, social media ads, Google Adwords, sponsorships, etc. If it helps drum up business as its primary function, then you can deduct it.

- Bank Charges & Fees - Don’t forget to add these up. Any foreign transaction fee, ATM fee, monthly service fee, etc. These can be deducted.

- Business Licenses & Fees - Do you pay a fee to maintain your business license? It’s deductible.

- Computer/Phone & other Equipment - It used to be that equipment purchases had to be depreciated over time, so you could only deduct the portion of the equipment that is the difference between what you bought it for, and what you can now sell it for. Fortunately, now you can leverage section 179 of the IRS code to deduct 100% of the equipment costs right away, as long as the purchases total under $1,000,000. So, if you use a device or other equipment exclusively for business, you can deduct it.

- Contracted Services - Many freelancers pay subcontractors to help with certain parts of a project. These contracted services are 100% deductible.

- Insurance - If neither you nor your spouse are eligible for employer-subsidized health plans, then you can likely deduct the cost of insurance premiums that you pay out of pocket. This is subject to some limitations, like it cannot exceed your earned income from your business. It is safest to check with a tax professional to ensure you deduct this correctly.

- Office Supplies - Any supplies normal to business use, exclusively for business use.

- Postage & Delivery - Do you send thank you cards to your clients? Do you mail your invoices? Any postage or delivery costs associated with your business are deductible.

- Repairs & Maintenance - Any repairs or maintenance to items relating to your business can be deducted.

- Utilities - Cell phone, electric, home internet, etc. If you use it for business, you can deduct the portion (approximate percentage) you utilize for business purposes.

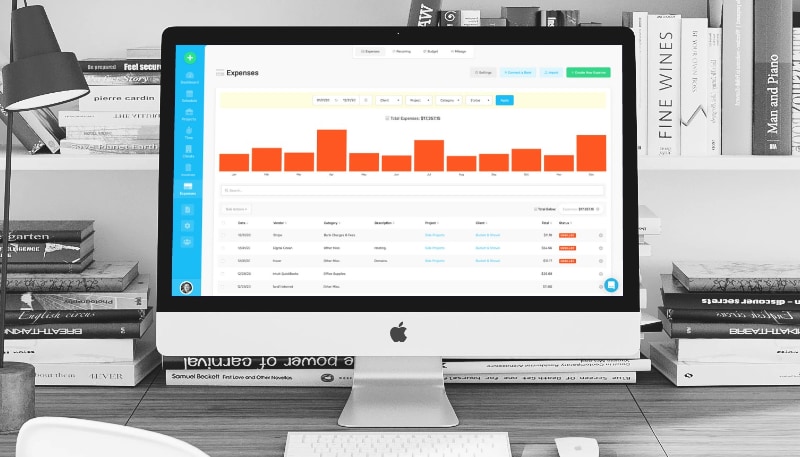

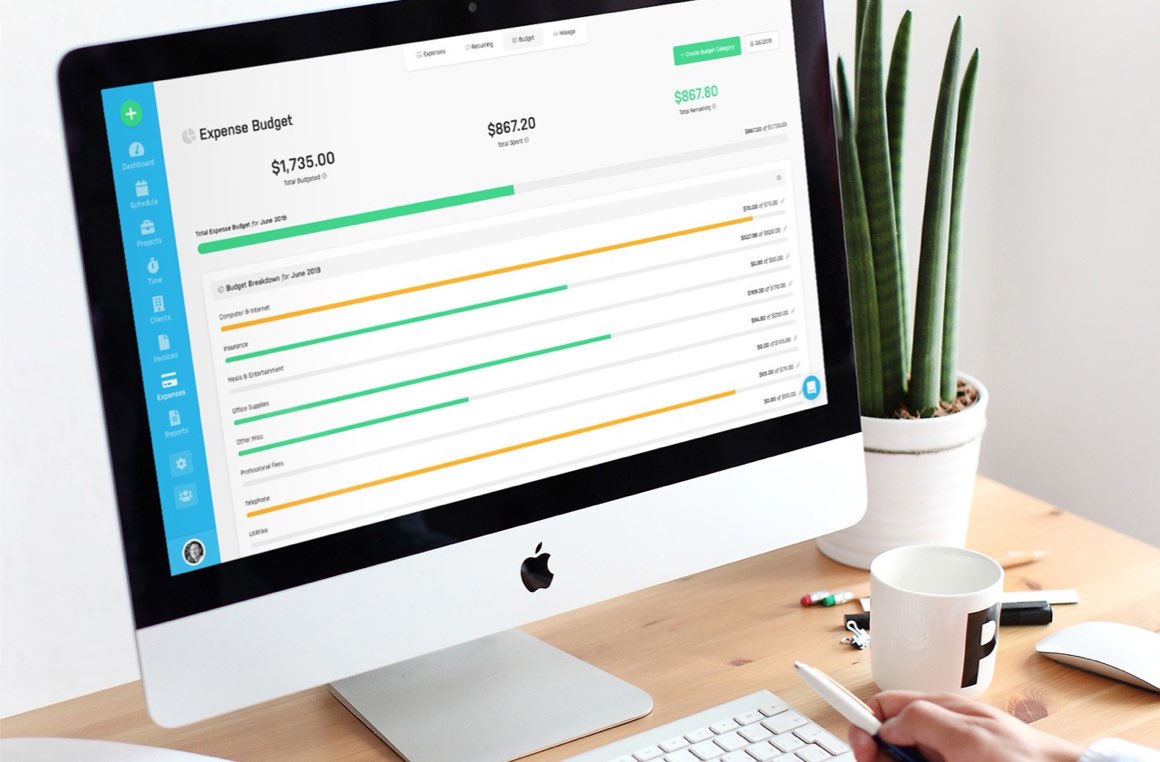

Keeping Track of Your Expenses

Knowing about all of these deductions is a good start, but you have to keep accurate record of all of them in order to include them in your tax return. One easy method of keeping track is to use a dedicated bank account or credit card for business expenses. This way, you can be sure that each expense is recorded the moment you pay money for it.

To make matters even simpler, tools like Harpoon can automatically import your expenses from a particular bank account or credit card, giving you insight into your business spending throughout the year (and making tax-time printouts a snap).

Harpoon has a few more features that make expense tracking as simple as possible:

- Upload expense receipts and attach them digitally for simple record keeping (you can ditch the shoebox!)

- Add expenses to an invoice if you need your client to reimburse you for the cost.

- Recurring expenses that can be set up once and repeat on a regular schedule that you set. This is useful for expenses like rent or subscriptions.

- Expense budgeting so you can set an amount for each expense category, and track your usage in real-time.

All of this in addition to simple reporting will ensure that your records are up-to-date, and you have clear vision on where your business stands financially.

The Bottom Line

IRS audits exist because people bend the rules or flat out make up numbers. As long as your expenses are legitimately used to run a business, and are not mixed into personal use, then you can safely deduct them. In the event of an audit, you will want to have clear records of your purchases, and may need to provide other proof of the purchase. For some purchases, you can deduct a percentage of an item if it is partly for personal use, but in some cases, like travel expenses, there are limits to being able to deduct personal expenses that have business use mixed in.

Keep track of your expenses, even the small ones, and record the miles you use for business purposes. Tools like Harpoon make it easy to add them all up at tax time and maximize your refund.

For more information about tracking and managing your business expenses check out our free guide to controlling your expenses.

Disclaimer: Harpoon and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.