What kind of revenue gets tracked on my Schedule?

There are two types of tracked revenue you’ll see displayed on your Schedule: Collected Revenue and Expected Revenue.

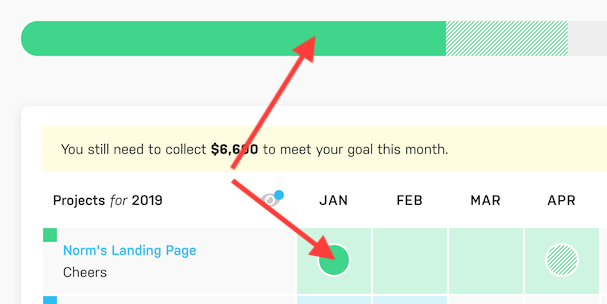

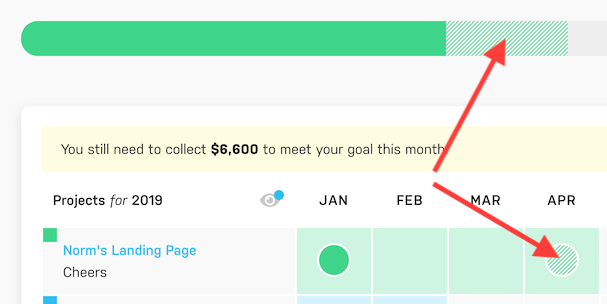

Collected Revenue: This represents all of the actual income you’ve received from your clients. Collected Revenue is represented by the solid green progress bar at the top of your Schedule (more about the progress bar in just a minute), and by the solid green circles within your Schedule’s calendar:

Expected Revenue: This represents all of the revenue you expect to receive, but haven’t received yet, which could include unbilled hours, unpaid invoices, future recurring invoices, fixed project budgets, or any expected revenue you've added manually using the "Add Expected Revenue" action at the top of your Schedule. (Refer to this article to learn more about these sources of expected revenue and how they work.) Expected revenue is represented by the striped green progress bar at the top of your Schedule, and by the striped green circles within your Schedule’s calendar:

To learn more about using the Schedule refer to these support articles.